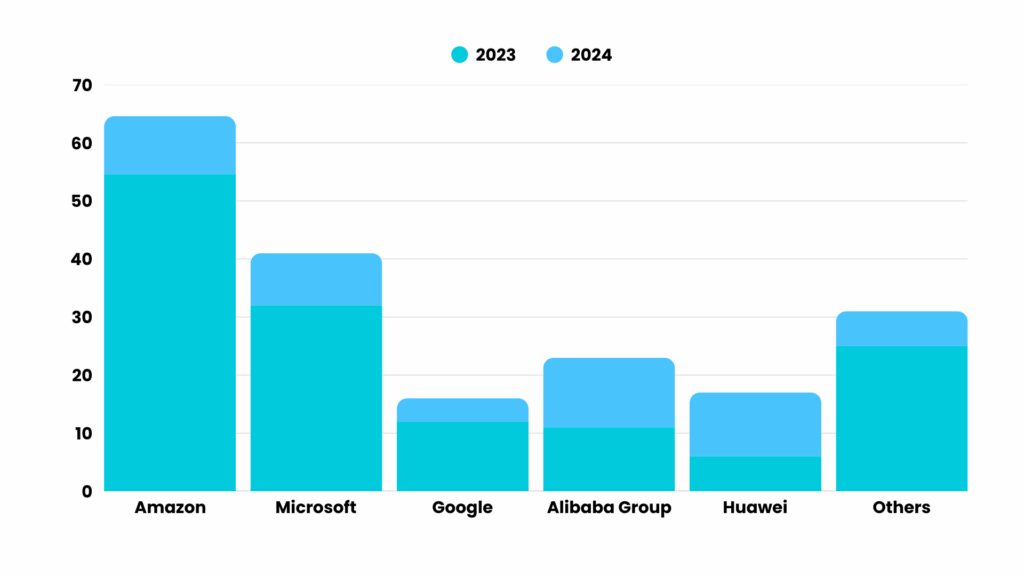

- IaaS market up 22.5% to $171.8B

- Hyperscalers dominate, but $30 billion+ open to challengers

- AI workloads are driving demand, with enterprises turning to alternative Clouds and GPUaaS for capacity

- Growth opportunities lie in speed, flexibility, compliance and specialization

The Infrastructure-as-a-Service (IaaS) rocket ship just keeps blasting higher. Gartner reports that the global IaaS market grew 22.5% in 2024, hitting $171.8 billion. Amazon, Microsoft, Google, Alibaba, and Huawei may have sliced off a staggering 82% of that pie—but that leaves more than $30 billion for alternative Cloud providers ready to fight for a piece of the action.

The good news is that concerns around data sovereignty, geopolitical disruption, and cybersecurity are all pushing businesses to look for a range of Cloud solutions.

“As enterprises continue to seek greater flexibility, improved resilience, and optimized performance, there is sustained demand for Cloud migration and modernization services,” said Hardeep Singh, Principal Analyst at Gartner.

“Enterprises want to transform their IT infrastructure by leveraging multiple platforms for AI and prioritizing modernization by migrating existing workloads to the Cloud. They are also deploying cloud-native applications across diverse environments.”

Translation: Enterprises aren’t just lifting and shifting. They’re building, experimenting, and making the Cloud theirs—and they’re not afraid to call in new players who can deliver exactly what they need.

AI is the accelerant

Cloud growth is always big news, but in 2024 one driver loomed larger than the rest: artificial intelligence. Training models, deploying applications, chasing the performance edge—AI is stretching infrastructure to its limits.

“Cloud providers are investing heavily in AI infrastructure and capabilities to become leaders in the rapidly evolving AI-optimized IaaS market,” Singh explained. “They expect that AI will become a much larger revenue contributor in the future, even though it currently remains a relatively small slice of their overall revenue within the IaaS space.”

This is a land grab, and the hyperscalers are throwing money, GPUs, and data centers at the problem. But here’s the twist: they can’t do it all, at least not fast enough. Enterprises aren’t waiting for the hyperscaler queue to clear—they’re turning to alternative Clouds and GPU-as-a-service specialists to keep their AI dreams alive today.

GPUaaS: The secret weapon

Singh points to one of the most exciting developments: “Emerging AI-optimized IaaS offerings from non-hyperscalers, or GPU as a service (GPUaaS) providers, though still nascent, have also played a key role in addressing immediate capacity requirements by offering flexible, high-performance compute on demand.”

That’s the sweet spot. GPUaaS providers are small, nimble, and fast. They’re not trying to be everything to everyone. They’re solving one of the most urgent problems in technology right now: how to get scalable compute capacity without waiting months for supply chains to catch up.

It’s not just about horsepower, either. Smaller providers can flex around customer needs, offer tailored support, and meet compliance requirements that don’t always fit neatly into a hyperscaler’s box. For enterprises juggling sovereignty, residency, and resilience, this agility is priceless.

Cloud concentration vs. diversification

Yes, the big Cloud names still rule the leaderboard. Amazon pulled in $64.8 billion from IaaS alone in 2024, owning 38% of the market. Microsoft followed with 24%. That’s a lot of gravity at the top.

But here’s the paradox: the bigger the giants get, the more enterprises feel the need to diversify. Multi-cloud strategies are no longer optional—they’re the default. Enterprises want choice, leverage, and the ability to plug into specialized ecosystems when it matters. That’s where alternative Cloud services providers become not just an option, but a necessity.

Modernization of IaaS is messy—and that’s good news

The Gartner data shows enterprises are migrating, yes—but more importantly, they’re modernizing. That’s never a clean, single-vendor process. It requires mixing and matching, shifting workloads around, and experimenting with new platforms until the right balance is found.

“Enterprises want to transform their IT infrastructure by leveraging multiple platforms for AI and prioritizing modernization by migrating existing workloads to the Cloud,” Singh said. Modernization is messy by design—and messiness creates openings for providers who can bring clarity, speed, and specialized solutions.

A wide-open future for the alt-Cloud market

The hyperscalers will keep their crown for now, but they don’t have the market locked down. Demand is exploding faster than any five companies can handle, especially in AI. That’s why alternative Cloud providers may suddenly find themselves in the spotlight, with an audience of enterprises eager to listen.

The opportunity is clear: don’t compete on scale, compete on speed, flexibility, and customer focus. Be the specialist Cloud, the second Cloud, the Cloud that solves a specific problem better than anyone else.

Because when the market grows 22.5% in a year, there’s no need to fight for scraps. There’s an entire feast waiting for providers ready to claim their seat at the table.

Your next read: Could UK regulation create more opportunities for alternative cloud providers?